Life insurance is often misunderstood, overlooked, or delayed — until it’s too late. But in 2025, with economic uncertainty, rising living costs, and a renewed focus on family protection, life insurance is more essential than ever.

If you’ve been putting it off or wondering whether it’s really necessary, this guide will break down why now is the time to secure a policy, what type you need, and how to get started without overpaying.

What Is Life Insurance and How Does It Work?

Life insurance is a contract between you and an insurance company. You pay a monthly or annual premium, and in return, the insurer pays a tax-free lump sum (called a death benefit) to your chosen beneficiary when you pass away.

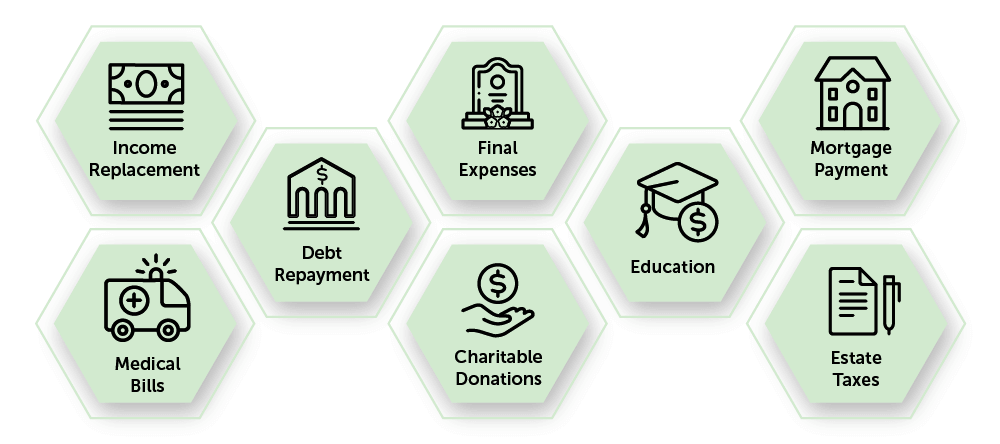

This benefit can be used for:

- Funeral and end-of-life expenses

- Paying off debts and mortgage

- Replacing your income

- Funding children’s education

- Protecting your family’s financial future

Why Life Insurance Is More Important Than Ever in 2025

1. Rising Living and Healthcare Costs

In 2025, the average American family is carrying more debt and paying more for essentials. A life insurance payout can help your loved ones maintain their standard of living during a difficult time.

2. Increasing Medical and Funeral Expenses

The average funeral in the U.S. now costs over $10,000. Life insurance ensures that those costs don’t become a burden for your family.

3. Life Changes: Marriage, Children, Home Ownership

If you’ve recently:

- Had a baby

- Gotten married

- Bought a house

- Taken on new financial responsibilities

4. Peace of Mind in Uncertain Times

With unpredictable global events, job instability, and health risks, life insurance is your safety net when the future feels anything but guaranteed.

What Type of Life Insurance Should You Get?

| Type of Insurance | Best For | Coverage Duration | Cash Value? | Cost |

|---|---|---|---|---|

| Term Life | Most families | 10–30 years | ❌ No | 💰 Lower |

| Whole Life | Lifetime protection + savings | Lifetime | ✅ Yes | 💰💰 Higher |

| Universal Life | Flexible coverage and investment | Lifetime | ✅ Yes | 💰💰 Variable |

✔️ Recommended: Start with a term life policy — it’s affordable, simple, and can be converted later.

How Much Life Insurance Do You Need?

A common rule:

10 to 15 times your annual income.

But it also depends on:

- Your current debts

- Future expenses (kids’ college, mortgage)

- Number of dependents

- Whether your spouse works

How Much Does Life Insurance Cost in 2025?

Surprisingly affordable — especially if you’re young and healthy.

| Age | $500,000 Term Policy (20-Year) | Non-Smoker |

|---|---|---|

| 25 | $18–$25/month | ✅ |

| 35 | $22–$30/month | ✅ |

| 45 | $45–$60/month | ✅ |

💡 Tip: The younger you buy, the lower your premium — for life.

Tips to Get the Best Rate

- Compare quotes from at least 3 providers

- Choose term insurance if on a budget

- Lock in rates now — they increase with age

- Maintain a healthy lifestyle to lower your risk profile

- Ask about no-exam policies if you’re healthy

Final Thoughts

In 2025, life insurance isn’t just for parents or the wealthy — it’s for anyone who wants to protect their loved ones from financial chaos. The earlier you act, the more affordable and impactful your coverage will be.