Owning a home is one of the biggest financial milestones — and protecting it with the right home insurance policy is just as important.

In 2025, rising weather-related claims, inflation, and smarter home technology have all impacted how homeowners shop for coverage. Whether you’re buying your first house or reviewing your current policy, this complete guide will help you understand everything about home insurance, including how to find the best deals online.

What Is Home Insurance?

Homeowners insurance is a financial safety net that protects your home and personal belongings from unexpected disasters. It also covers you if someone is injured on your property.

A typical policy covers:

- Your house (structure and foundation)

- Detached structures (garage, shed, fence)

- Personal property (furniture, clothes, electronics)

- Liability protection (injuries or damage you cause to others)

- Additional living expenses (if your home is unlivable after a covered event)

What’s Not Covered?

Even the best policy won’t cover everything. Common exclusions:

- Flood damage (you need separate flood insurance)

- Earthquake damage (available as an add-on)

- Normal wear and tear

- Pest infestations (termites, rodents)

- Poor maintenance or negligence

📝 Tip: Always read your policy carefully to avoid surprises at claim time.

How Much Does Home Insurance Cost in 2025?

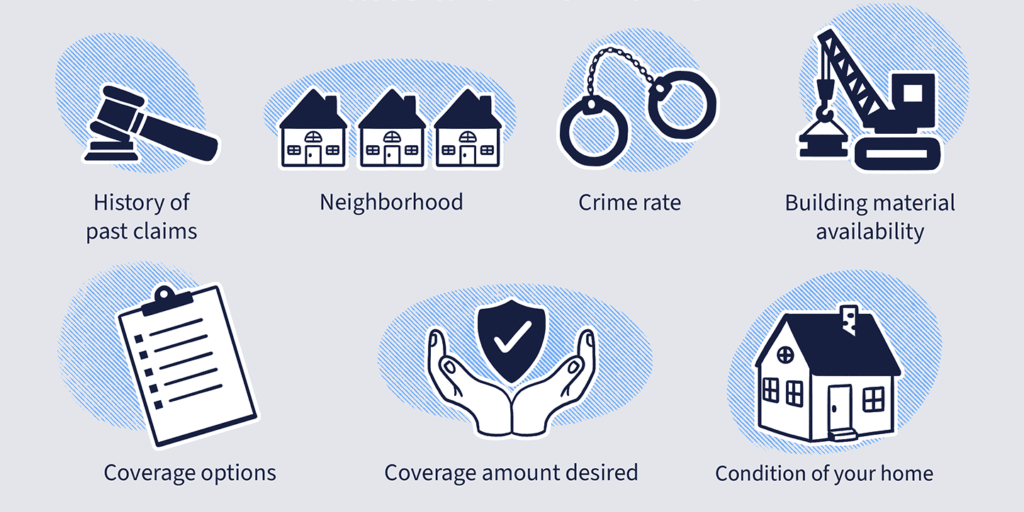

The average annual premium in 2025 is between $1,300 to $2,000, depending on:

- Your location

- Home value

- Age and condition of the property

- Coverage limits

- Credit score and claim history

- Security systems or fire alarms installed

Average Annual Premium by State

| State | Avg. Premium (2025) |

|---|---|

| Texas | $2,100 |

| Florida | $2,400 |

| California | $1,800 |

| Ohio | $1,250 |

| New York | $1,600 |

💡 Install smart smoke detectors, deadbolt locks, or a home security system — they can save you up to 15%!

Types of Homeowners Insurance (HO Policies)

| Policy Type | Who It’s For | Coverage Type |

|---|---|---|

| HO-1 | Basic coverage | Limited named perils |

| HO-3 | Most homeowners | All-risk dwelling, named personal property |

| HO-5 | High-value homes | All-risk for dwelling and belongings |

| HO-6 | Condo owners | Condo unit + liability |

| HO-4 | Renters insurance | Belongings + liability |

For most homeowners, HO-3 is the go-to choice — balancing broad protection and affordability.

How to Find the Best Home Insurance Policy

✅ Compare Quotes Online

Start by comparing policies from top-rated providers in your area. You’ll be surprised how much prices vary.

✅ Choose the Right Deductible

A higher deductible = lower premium. Just make sure you can afford it in case of a claim.

✅ Bundle With Auto or Life Insurance

Bundling can save you up to 25% with many companies.

✅ Ask About Discounts

Common discounts include:

- No recent claims

- Smart home security systems

- New or renovated home

- Paying annually

Top Home Insurance Providers in 2025

| Company | Best For | Highlights |

|---|---|---|

| Lemonade | Tech-savvy homeowners | Fast claims, low rates |

| State Farm | All-around coverage | Great customer service |

| Allstate | Bundle deals | Many discount opportunities |

| Hippo | Modern home coverage | Includes smart home monitoring |

| Liberty Mutual | Customization options | Flexible coverage tiers |

🔗 Compare home insurance quotes instantly and find your best rate.

When Should You Review Your Policy?

✅ Annually – to compare premiums and upgrade coverage

✅ After a renovation – your rebuild cost may have increased

✅ After buying valuables – update personal property limits

✅ After local natural disasters – evaluate flood or wildfire add-ons

Final Thoughts

Home insurance isn’t just required by mortgage lenders — it’s the smart, responsible way to protect your investment and your peace of mind.

Whether you’re switching providers or buying for the first time, use 2025’s powerful online tools to compare quotes, understand what’s covered, and lock in a policy that fits your home and your budget.